RETIREMENT PLANNING

Retirement planning for high-net-worth families extends beyond simple savings. It’s a sophisticated process that encompasses wealth preservation, investment optimization, and the creation of a lasting legacy. Proper planning for retirement touches on almost every aspect of the financial planning process. Thoughtful retirement design involves identifying assets best suited to generate income during retirement, contributing to your overall wealth management plan. Our approach is tailored to meet the unique needs of affluent families, providing strategies aligned with your sophisticated financial landscape.

Contact us today to explore how we can further your retirement planning.

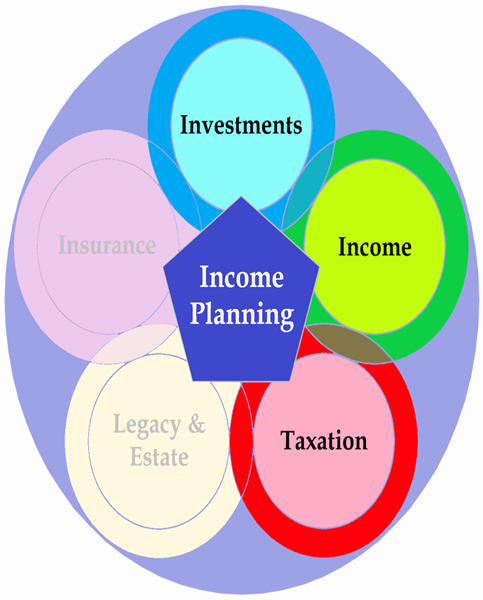

INCOME PLANNING

Affluent families can derive income from a multitude of sources. Our planning process addresses the proper timing of income and withdrawal strategies in coordination with CPAs for tax optimization. Proper design will incorporate Required Minimum Distributions (RMDs), Social Security, dividends, earned interest, capital gains, rental income, annuity payments, etc. Our customized approach caters to the unique conditions of affluent families, offering strategies that harmonize seamlessly with their intricate financial context.

Contact us today to explore how we can enhance your income planning.

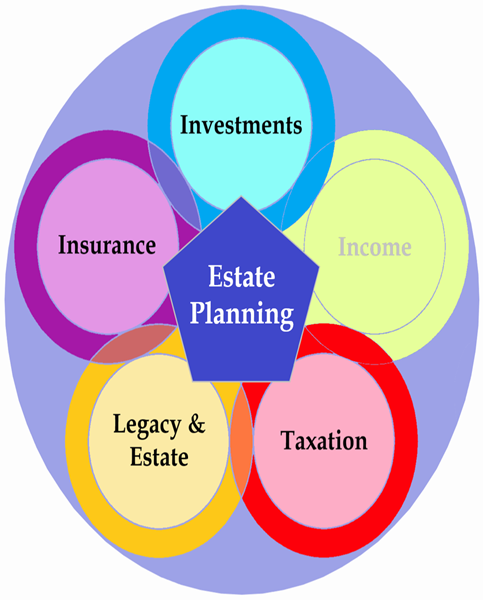

ESTATE PLANNING STRATEGIES

Estate planning is not just about death, but more about life everlasting. While collaborating with our client’s attorneys, our meticulous process involves seamless coordination of investment strategy and insurance solutions. Beyond wealth preservation, estate planning can help safeguard your legacy, shields loved ones and empowers informed choices for generations to come.

Contact us today to explore how we can expand your estate plan.

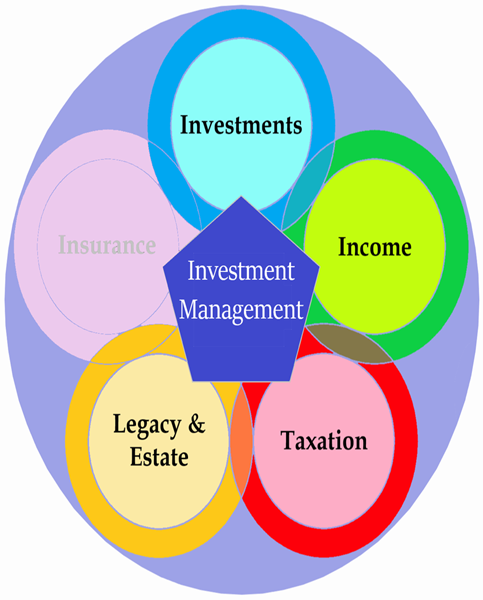

INVESTMENT MANAGEMENT

Our portfolio design encompasses a rich array of investment options, meticulously curated for each client. We work with families to help provide a customized investment strategy through our rigorous research and due diligence process. Within a comprehensive financial plan framework, we discern and select investments that align seamlessly with the unique and aspirational goals for all.

Contact us today to explore how we can optimize your investment strategy.

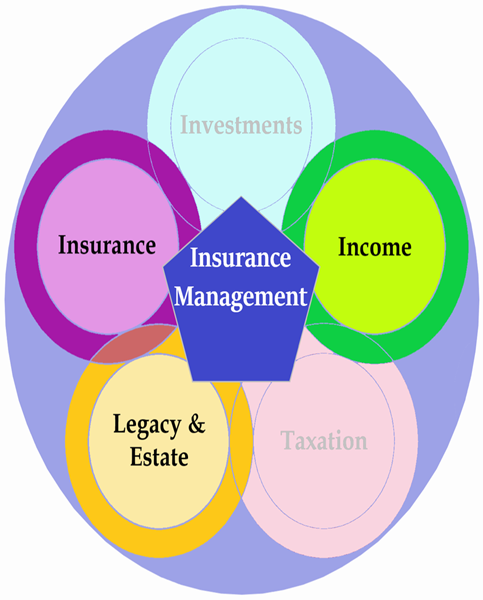

INSURANCE MANAGEMENT

Comprehensive financial planning transcends mere investment strategy. It acknowledges life’s inevitable milestones: retirement, disability, and mortality. Our approach extends beyond insurance as a risk hedge. By working with you to integrate life insurance, disability insurance, and long-term care insurance with sound investment strategies, affluent clients seek to maximize their planning results and help ensure outcomes.

Contact us today to explore how we can appropriately address your insurance needs.